Easy Tips to Manage Cash Flow Using Accounting Software in 2021

Top Benefits of Multi-Store Liquor POS Systems

February 3, 2021

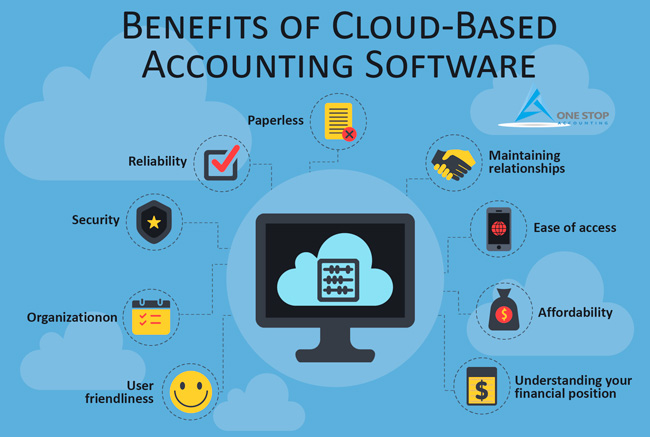

Benefit of Cloud Accouting Software For Small Business

February 16, 2021One of the simplest ways to make sure your small business’ success is thru well-managed finances. for several small businesses, financial success is balanced on a fine line between assets and accounts payable. While a fragile balance to take care of, businesses could practice it and be largely successful—at least, until 2021.

Studies show nearly a 3rd of companies fail because they run out of money. Adding the economic shock of the pandemic meant even the foremost carefully managed finances risked falling prey to a income crisis.

Now, quite ever, income is king, and it’s imperative to stay it in restraint with the proper practices and therefore the right accounting software to avoid issues. Our experts share 7 tips to keeping your income in restraint using your accounting software.

1) Keep a Cash Flow Forecast

Set targets for subsequent six to 12 months to stay track of finances and avoid any shortfalls. The foremost basic thanks to found out a income forecast is to take care of an easy report listing income and costs on a monthly basis. Accounting software also can assist you keep track of trends in spending. Note of any differences due to the season, like heating bills that rise in winter. Think about fixed and variable costs to your income forecast and be realistic: Include every item.

2) Stay on Top of Payments

Send an invoice to get a quick to chase overdue bills. It’s also worth establishing clear payment terms with new suppliers before you begin doing business with them. Thirty days is standard but, during a pandemic, you’ll be ready to negotiate shorter terms.

Get to understand your customer payment dates and don’t ignore irregularities or delays; a poor paying customer could be close to go bust. Knowing when you’re thanks to be purchased a product or service will assist you keep it up top of your income.

3) Watch Your Stock Management

Efficient stock management is simply as important as managing income. Reconcile stock records at an equivalent time you reconcile your bank account—whether that’s weekly or monthly—so you recognize which items you’ve got left available and which require reordering.

An efficiently managed stock system will have a positive impact on your income by preventing holding an excessive amount of stock and having all of your money engaged in it.

4) Stay Friendly with Lenders

Many businesses need cash boost from a bank or lender every now and again and might need credit or an overdraft to urge up and running. Stay good terms together with your financial institutions, keeping them informed of any unforeseen outgoings or changes in forecasts.

By developing an honest relationship supported trust with banks and lenders, they’ll be more likely to treat you favorably should your business need future financial assistance.

5) Access Credit

If your business is growing rapidly enough to cause concern about having enough money to satisfy your overhead, seek access to a line of credit from a bank or financier, like an overdraft or short-term loan. In many cases, banks are willing to lend to a business if they will see a draft contract or letter of intent.

Once the client pays, then you’ll pay your debt. You’ll only need to pay interest to the bank or financier for the quantity of your time you really need the cash.

6) Tighten Up on Outgoings

Assess the frequency where you can pay suppliers, tax bills, utilities, etc. it’s possible to pay installments to make the terms more flexible? You’ll be ready to negotiate deals that are more favorable to your business.

Also, watch the small expenses that over time can add up. You would possibly be surprised how watching pennies helps the dollars prop up.

7) Anticipate Problems Before They Happen

Identify potential income problems beforehand by regularly updating your income forecast, monitoring market conditions, keeping an eye fixed on customers and suppliers who could also be in trouble and taking action as soon as you see a drag. By using your accounting software reports to stay on top of your income, you’ll be ready to affect problems quickly and efficiently. For extra guidance, consider speaking with an accountant, investor, or business mentor.

Be Prepared With the Right Accounting Software

Your business legitimately cannot afford to lose track of money flow and finances. The proper accounting software can help organize expenses, bill clients, and keep an eye fixed on rock bottom line. Accounting software can’t prevent every income crisis, but it can provide the insight you would like to organize you for regardless of the future might appear as if.