MYOB Accounting Software Singapore

MYOB accounting software is well known in Small and Medium Enterprises for its dual-language interface – English and Traditional Chinese. Working with multiple currencies, Provides employer’s returns IR56B for Inland Revenue, it is the designated accounting software for LCCI level 2&3 and also for computerized accounts for HKIAAT.

MYOB Software :

MYOB Singapore is a real-time accounting and User-friendly interface to get your business performance at your fingertips.

MYOB software is one of the best and easiest software that are available at an affordable prices and is useful for small businesses.

MYOB Singapore – Key Features

Provides English & Traditional Chinese Interface. Supports Data Entry in both Languages

One Take Accounting Process

Each Entry in this software will be automatically recorded as double entries which saves your resources and make the entry easier. Apart from possessing of the basic functions of Sales, Purchase, and Inventory, it also has the functions of project management, customer relationship management, multi-currencies transactions, multi-location inventory management, bank reconciliation and payroll management. It is an integrated system fulfilling the diversified needs of different customers.

User Friendly Learning

MYOB Software has a simple and clear layout making it user-friendly for first-timers to walk through the application. Working with sales and purchase documents and printing cheque has never been easy without MYOB.

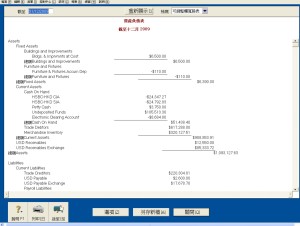

170+ Financial Reports for Business Intelligence

Detailed analysis reports like Customer Account Receivables Analysis Report, Sales Analysis Report, Bank Reconciliation Report etc can be auto-generated and gets updated automatically after any data inputs and adjustments giving a real-time view of the business and financial status. The daily use reports like Balance Sheet, Profit & Loss Report, Trial Balance, and Cash Analysis Report are also available in the application.

MYOB OfficeLink

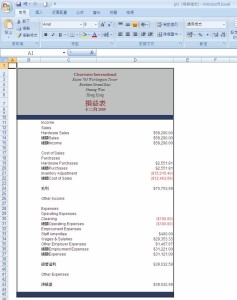

This feature extends MYOB’s functionality with MS office applications like Excel and Word.

Real-time reports can be generated and exported to excel for advanced analysis using formulas and special functions, to know about financial accounting and inventory stock count.

The word extender feature helps to print customer invoices, invitation and thank you letters, item promotion letter, surveys, and labels.

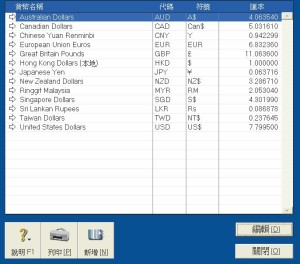

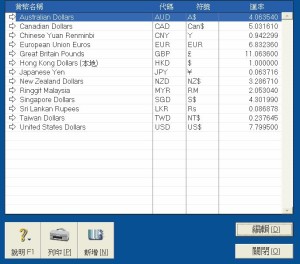

Multi-currency Registers. Automatic Exchange Difference Calculation

MYOB is one of the few international accounting software in the market that handles multi-currencies. Whatever multi-currencies transactions you entered, exchange difference is automatically calculated in it.

Support Multi-users and Multi-locations for concurrently Data Input

Multiple users can access its data file. Staff from different departments of the company can concurrently use MYOB for issuing an invoice, journal entries etc.

Set User Password and Authority Levels

You can set unlimited usernames and passwords with different authority levels to limit their access to some of the screens or reports

Efficient Report Printing & Output

MYOB can print or email quotations, invoices to customers which is environment-friendly and efficient.

Manage and Process Payroll. Produce Returns Conform to Regulatory Requirements

MYOB provides all-around payroll processing and management from recording data such as employee’s background information, payroll scheme, leaves, MPF entitlement, and printing payment slips to producing Employer’s Returns IR56B that conforms to regulatory requirements. MYOB’s Payroll Management enhances operational efficiency.

Offers Multi-location Inventory. Supports Items In-and-Out Analysis

MYOB records item name, location, pricing and prompts back-order reminders and automates stock level adjustment. It makes inventory management easy.

You can start your journey with Myob accounting software:

– Get a Complete Full view of your business

– Make sure nothing is missed

– MYOB is Easy to use and you can run in just a minutes

– Everything will be available on the same page

Government Grant:

For New Budget 2013, for Years of Assessment (YAs) 2013 to 2018, businesses that invest in qualifying activities under the Productivity and Innovation Credit (PIC) scheme

This is giving 400% tax deductions/allowances and/or 60% cash payout (“PIC cash payout”) under the PIC scheme.

For more information, do call us now at +65-6227 1797