Use Payroll Softawre for Itemised Payslip From 1 April 2016

How to view my staff invoice and accounts when i am overseas?

December 3, 2012

How To Create Chart Of Account In Sage_Ubs Accounting Software?

November 28, 2015

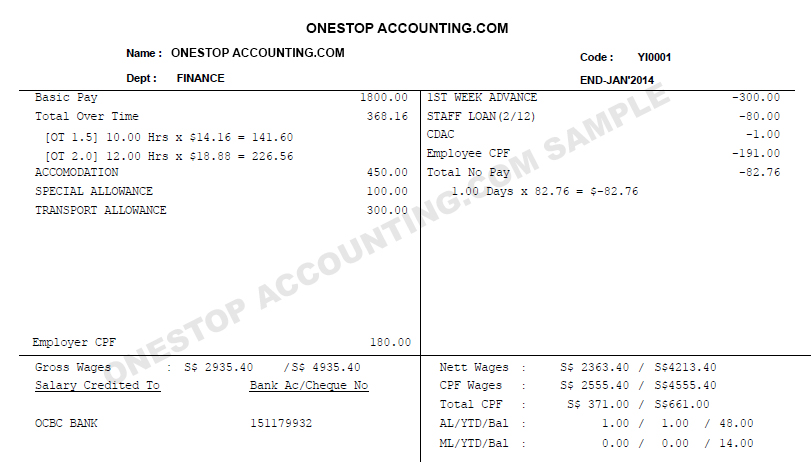

From 1 April 2016, all employers will be required to issue itemised payslips to employees covered under the Employment Act.

With that, we strongly advised all companies to purchase a payroll software compliance to Singapore guideline for itemised payslip generated for payroll software

Itemised payslip format would include:

– Full name of employer.

-Full name of employee.

-Date of payment (or dates, if the payslips consolidates multiple payments).

-Basic salary

For hourly, daily or piece-rated workers, indicate all of the following:

- Basic rate of pay, e.g. $X per hour.

- Total number of hours or days worked or pieces produced.

-Start and end date of salary period.

-Allowances paid for salary period, such as:

- All fixed allowances, e.g. transport.

- All ad-hoc allowances, e.g. one-off uniform allowance.

-Any other additional payment for each salary period, such as:

- Bonuses

- Rest day pay

- Public holiday pay

-Deductions made for each salary period, such as:

- All fixed deductions (e.g. employee’s CPF contribution).

- All ad-hoc deductions (e.g. deductions for no-pay leave, absence from work).

-Overtime hours worked.

-Overtime pay.

-Start and end date of overtime payment period (if different from item 5 start and end date of salary period).

-Net salary paid in total.