Payroll Software

Our applications from Sage_Ubs and Ez payroll offer the best in class software for all your payroll needs. With an expanding and comprehensive range of applications, One Stop Accounting ensures to cater all the needs of an individual company.

Payroll plays an integral role in a company’s financial and business growth and with the right choice of software from us it is easy and effective to manage to lower the administrative costs and to provide a detailed insight on the Company’s financial status helping to stay ahead of the competition in Singapore.

Being the market leader in accounting and payroll software providing the best products with an excellent after the sale support OSA is the right choice for your Company.

What are you waiting for? Call us for a free demo.

Our Payroll applications cover functionalities.

Basic Computations

- Staff payroll based on different working hour table

- Staff allowance

- Staff Deductions

- Staff Overtime

- Staff Levy

- Annual leaves

Other Functions

- Automatic computing function for CPF contribution

- Automatic computing function for SINDA/CDAC/MBMF/ECF/SDL

- Automatic reminder of staff leave

- Online leave submission via our cloud application

- Bank Giro Submission

- Real time reporting for payroll

- Real time IR8A/IR8S forms submission

- Project staff salary computation (e.g construction firms)

- Multiple modes of payment to staff (e.g cash/giro/cheque)

- Leave approval module (e.g HR Manager can view and reject staff leave), a copy via email will be notified to staff)

- Real time printing of pay slips to staff

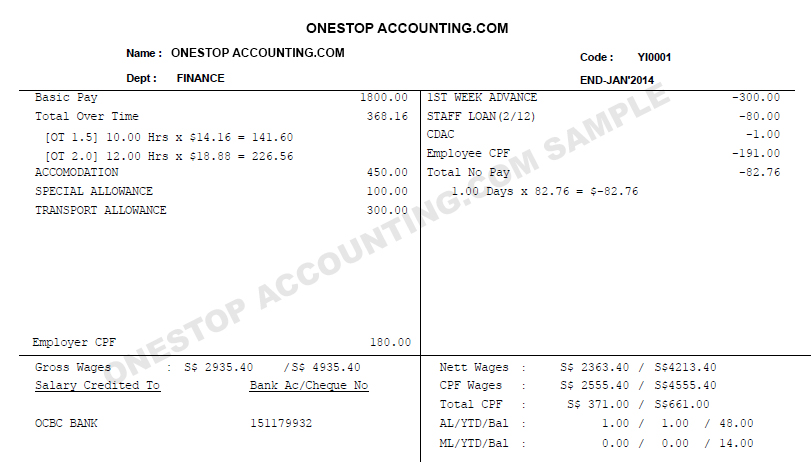

As per Singapore MOM it’s mandatory to have an Itemized pay slip. Below is a sample subject to customization based on request.

Government Grant:

For New Budget 2013, for Years of Assessment (YAs) 2013 to 2018, businesses that invest in qualifying activities under the Productivity and Innovation Credit (PIC) scheme. This is giving 400% tax deductions/allowances and/or 60% cash payout (“PIC cash payout”) under the PIC scheme.

For more information, do call us now at: +65-6227 1797